The growth of e-commerce is typically followed by the emergence of logistics service providers (LSP) with the ability to cater to specific delivery needs created by e-commerce. We are living in a time where the application of emerging technologies such as drone transportation, robotic-assisted picking, AI algorithms for automated fulfillment etc. have enabled people to receive same-day e-commerce delivery in some parts of the world. Chinese e-retail behemoths Alibaba and JD.com were able to flourish in China because of the strong logistic support provided by Cainiao and JD logistics respectively.

As e-commerce matures, consumer expectation on delivery rises. Hence, Alibaba is planning to invest US$ 15.58 billion to develop a smart logistics network which can ensure 24-hour delivery across China and 72-hour delivery for the international market.[1]

In India, where the demographic profile of consumers and infrastructural challenges are similar to Bangladesh to some extent, major e-commerce players are heavily investing in their captive logistics wing, while at the same time third-party logistics (3PL) service providers such as E-com Express, Delhivery, Go Javas etc. are expanding by leaps and bounds attracting international investments. For instance, Delhivery, valued at US$ 1.6 billion has received US$ 350 million funding from SoftBank this year.[2]

A fully functional e-commerce logistics service provider usually provides value-added or fulfillment services such as packaging, warehousing, order pickup, security, online tracking and database management for their e-commerce partners. Globally, an e-commerce logistics player might provide all or some of these services.

Bangladeshi E-commerce Hits an Inflection Point

E-commerce has evolved in Bangladesh as a by-product of the digital revolution. The journey of internet commerce in Bangladesh began in the early 2000s and achieved significant momentum after 2009 when players such as ajkerdeal, rokomari, and akhoni (now bagdoom) entered the market.[3] Bangladeshi consumers, backed by increasing disposable income and improved access to technology, are rapidly adapting to online shopping. The industry is set to grow exponentially from its current estimated size of USD 70.87 million to USD 344 million by the year 2023 while the number of orders in a year is also projected to increase from 9.6 million to around 34 million.[4]

Recent entrance of online retail giant Alibaba into the Bangladesh market through the acquisition of Daraz will change the industry dynamics. E-commerce Association of Bangladesh (E-CAB) is anticipating that the proposed entrance of Walmart and Amazon will further accelerate the growth of domestic e-commerce industry. The industry growth will accelerate due to an even faster consumer adaptation rate, increase in order numbers, and entry of more international players. However, absence of an e-commerce centric logistics system is a vital factor which must be taken into account.

How Fast is Fast Enough?

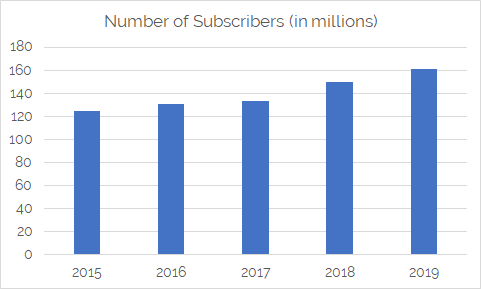

Backed by the increasing availability of affordable smartphones and the rollout of faster and more reliable mobile telecommunication services, Bangladesh’s internet user base continued to grow in 2018. According to Bangladesh Telecommunication Regulatory Commission (BTRC), the total number of internet subscribers stood at 91.421 million at the end of January 2019. It is predicted that the number of smartphone users will reach 138 million resulting in a 75% penetration rate by the end of 2025.[5] All of these data indicate that the digital ecosystem needed to render a digital economy is taking its shape gradually. Bangladesh has observed the growth of its first generation of truly digital consumers who look for solutions online and purchase using digital payment methods on a regular basis. In the coming years, technology adaptation will be even faster, as flocks of millennials will start to join the digital economy. Additionally, owing to worsening traffic congestion and busy schedule of urban lives, more people will be placing orders online. Hence, the daily order size will rise significantly. The real concern here is whether the e-commerce companies can deliver the orders within the promised time frame.

In Bangladesh, if five people are asked about the reason behind their reluctance to order online, at least two will mention delivery as a prior concern. One of the major purposes of e-commerce is to truncate the hassles associated with traditional shopping, and if it fails to do that, consumers’ e-commerce adoption rate will remain low.

Success Lies in the Second-mile

At present, 500 e-commerce and 2,000 f-commerce (i.e. companies that operate through Facebook pages only) companies are registered under E-CAB and each one of these does not have the capability to run its own fleet. As a result, they have adapted to different delivery models to fit their needs based on capital expenditure requirement, control, flexibility etc. Majority of them have to make a choice from the following categories:

| Type of Logistics Service Providers | Traditional Logistics Service Providers | Captive Logistics Arms by E-commerce (Own Fleet) | E-commerce Logistics Companies (3PL) |

|---|---|---|---|

| Range of Services | Mostly second mile delivery and warehousing facility | Specific functions required by the company | Full-range, as per e-commerce client’s requirement |

| Example | Bangladesh Post Office (BPO), Sundarban Courier, S.A. Paribahan, Continental Courier | Daraz’s In-house Logistics Wing (Partial Coverage) | Paperfly, Pathao, E-courier, Biddyut |

TABLE: Range of Service Provided by Each Type of Logistics Service Provider

Currently, no Bangladeshi e-commerce player owns a full-fledged logistics wing, which is able to provide a full range of delivery assistance. The first-mile logistics services i.e. e-commerce delivery inside major cities are offered by a number of 3PL providers such as Pathao, Bidduyt, Paperfly, E-Courier etc. The second mile means delivery from Dhaka to other districts. Except for a few traditional LSPs such as Sundarban Courier Service, S.A. Paribahan, Bangladesh Post Office, no other player has entered this segment yet. The last mile delivery indicates inter-district delivery which e-commerce companies conduct through either franchise model or own fleet.

Interviews with representatives from leading e-commerce players have revealed that majority of the orders are placed by the urban consumers and fewer orders are received from the remote and rural parts of the country presently. However, the government plans to set up 100 economic zones all over the country, which will create 10 million additional jobs by 2030.[6] Additionally, an estimated urbanization rate of 42% by 20257 indicates that in the coming years, digital consumers backed by increased buying power will be placing orders from all over the country. The geographic dispersion of orders will definitely require a seamless delivery mechanism that is not possible without focusing on the second-mile and last mile logistics.

FIGURE: E-commerce Logistics Value Chain in Bangladesh Market

Making the Logistics Ecosystem Smart

In recent years, omni-channel retailing has been gaining popularity in Bangladesh creating a demand for sound logistics system in the second and third mile. In order to thrive, the goal of both traditional and online retailers should be to make the whole logistics ecosystem smart, optimized and predictive. Traditional logistics companies have the combination of expertise, experience, and vision, but lack in tech-enabled services such as tracking of order, automated fulfilling and return management etc. E-commerce centric logistics start-ups have technology incorporated services better suited for online retailers but face shortage of expertise in labor management and do not have the capital required to build second or last mile fleet.

During the previous century, the only success mantra for the retail industry was ‘location. location. location.’ This will be replaced by ‘distribution. distribution. distribution.’ In order to leverage the true potential of the growing digital consumer class, businesses must invest in crafting a smart logistics ecosystem to ensure fast and seamless delivery of online orders.

This article was written by Silvia Rozario, a Business Consultant at LightCastle Partners. For any queries, she can be reached at silvia.rozario@lightcastlebd.com. The article was originally published on “LightCastle Insights 2019“.

The post E-commerce Logistics: The Pivotal Element in E-commerce Success appeared first on LightCastle Partners.

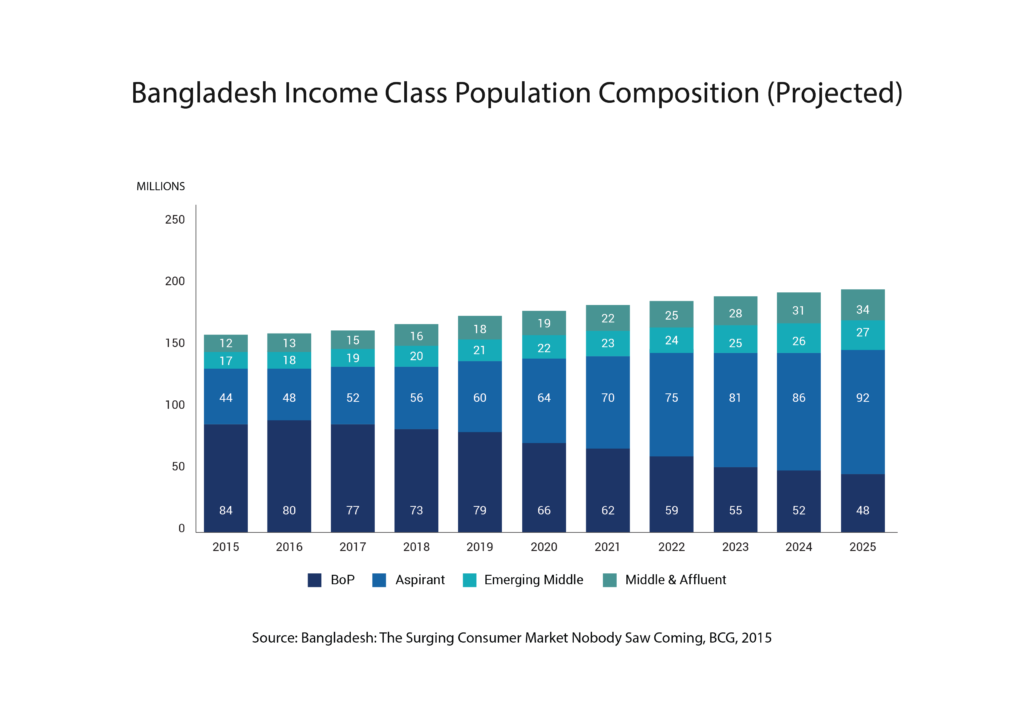

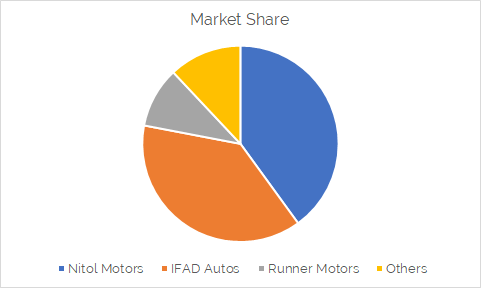

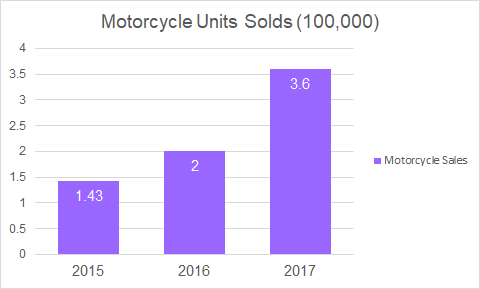

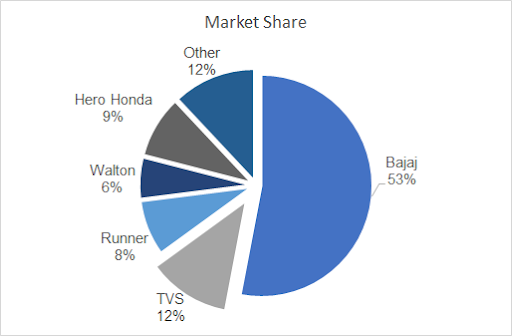

As the middle class grows in Bangladesh, smartphone usage has also dramatically increased. It is the ninth-largest smartphone market by unique consumers and as of 2017, smartphone penetration reached half of the population at 51%.[9] This is expected to grow with a CAGR of 3% to 82% (107 million users) by 2025.[9] Ride-sharing apps such as Pathao and Uber have benefitted from the motorcycle industry’s growth as they have been able to reach more customers and have further increased demand for motorbikes, causing more people to purchase motorbikes in order to make money through these apps.[4][6] It makes sense to hypothesize that as smartphone penetration increases and ride-sharing apps soar in popularity, motorbike sales will continue to grow.

As the middle class grows in Bangladesh, smartphone usage has also dramatically increased. It is the ninth-largest smartphone market by unique consumers and as of 2017, smartphone penetration reached half of the population at 51%.[9] This is expected to grow with a CAGR of 3% to 82% (107 million users) by 2025.[9] Ride-sharing apps such as Pathao and Uber have benefitted from the motorcycle industry’s growth as they have been able to reach more customers and have further increased demand for motorbikes, causing more people to purchase motorbikes in order to make money through these apps.[4][6] It makes sense to hypothesize that as smartphone penetration increases and ride-sharing apps soar in popularity, motorbike sales will continue to grow.