Whenever the agenda of growth-drivers is in focus within the context of Bangladesh, the conversation is rarely bereft of the Ready-Made Garments (RMG) Industry. In terms of employment, The Center for Policy Dialogue (CPD) reported that the sector employs approximately 3.5 million people, of which, approximately 60.8% are women.[1] The country’s RMG exports make up the majority of its overall exports, standing at 84.21% as of 2018-2019.[2] In terms of factories, there are approximately 4,621 active Garments Factories in Bangladesh.

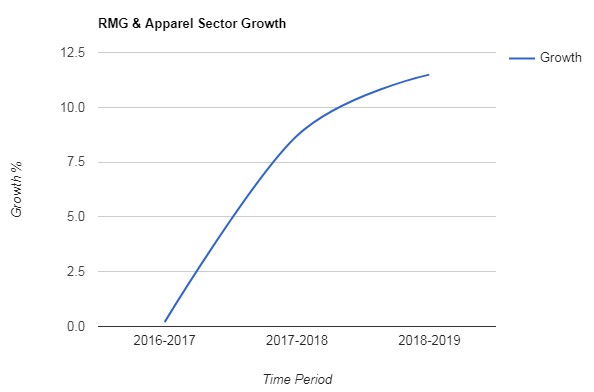

The recent growth of the industry seemed to be on an upward trend, registering 0.2% growth, 8.7% growth and 11.49% growth for 2016-17, 2017-18, and 2018-2019 respectively.[3]

The gradual traction achieved over these years in terms of growth may have been achieved due to:

- The growth of exports to non-traditional markets such as Africa.

- A depreciating currency allowing for easier exports.

- The increase in demand of RMG as an effect of the US-China Trade War.

However, it is important to note that there has been a 5.71% downturn in RMG exports for July-January of FY 2019-2020, indicating underlying issues which seem to be constraining the growth of this key industry and slowing down achievement of the goal of USD 50 billion export earnings by 2021.[4]

One of the major export destinations for the Bangladesh RMG sector is the US. It was thus expected that the US-China Trade war would mean a sustained proliferation in the exports of Bangladesh RMG, however this has not yet yielded sufficient benefits. A global economic slowdown throughout 2019 has meant that demand for Bangladesh RMG products, and derived demand for textiles, have declined. Other countries have gained relatively more in terms of exports growth from the trade war.

An overvalued exchange rate has lowered export competitiveness. The global growth in fast-fashion trends has capitalized on consumer convenience through digitization and captured some of the market previously occupied by Bangladesh apparel exports. Many of the international buyers are also ‘near-shoring’- which means directly purchasing from a country close to the end market.

A recent survey analysed the data of 36 listed companies in the Textiles sector of Bangladesh for the 2011-2018 period, concluding that there was a plummet in their net profits to BDT 341 crore in 2018 from over BDT 1,252 crore eight years ago.[6] Given steady annual inflation, this figure is a snapshot of the ailing industry.

Given the fulcrum-like role played by the RMG sector in driving forward the growth of Bangladesh, there is a large incentive to reinvigorate the sector.

LDC Graduation and the Long Road Ahead

Bangladesh is expected to graduate from Least Developed Country (LDC) status by 2024, having met all the required criteria as set in the Committee for Development Policy review of 2018. If able to graduate, it entails the withdrawal of certain International Support Measures which are exclusively provided to LDCs. While some of these measures relate to developmental policy and ease of participation with International bodies such as the UN, the withdrawal with arguably the most consequence would be the revocation of the Generalized System of Preference (GSP) facilities when exporting.

Essentially, this means that export costs are likely to rise as Bangladesh will no longer receive quota-free and duty-free benefits that LDCs generally receive, and will have more stringent rules-of-origin schemes on all its exported products. Given a smooth transition out of LDC status, Bangladesh will continue to remain eligible for preferential tariffs under the Everything But Arms (EBA) scheme in terms of access to the European Union (EU) Market for 3 more years. However, with the expiry of the current regulation of GSP at the end of 2023, it will have to wait until the formulation of the new regulation to assess and cope with the expectedly higher tariffs.[7]

Bangladesh, as an LDC, also enjoys the benefit of the Single Transformation rule, which states that exported products are subjected to preferential treatment upon fulfilling the criteria of one stage of transformation. This means that raw materials require only one stage of value-addition in the process of being converted to finished goods. In the case of non-LDCs, at least Double Transformation is necessary. This is especially concerning for RMG products from Bangladesh as it has heavy reliance on imported raw materials– mainly cotton. To put further emphasis on this, it is important to note that Bangladesh has the 2nd largest quantity of imports of cotton worldwide, behind only to China, with a value of USD 6.8 Billion.[8]

The Center for Policy Dialogue (CPD) estimates that Bangladesh will face an additional 6.7% additional tariff on average, after graduation which translates to loss in approximately USD 2.7 billion of export, a large constituent of which would be loss in RMG export.[9]

Bangladesh has the option to acquire the EU’s Special Arrangement for Sustainable Development and Good Governance (GSP+) facility through the fulfillment of certain criteria. This would once again allow for preferential treatment of exports post-LDC graduation. However, the main criteria that Bangladesh will have difficulty in achieving includes strict compliance with the 27 International Human Rights Conventions, and the lowering of export concentration to the EU (which is currently higher than the maximum threshold of the criteria).

The key to securing GSP+ features may lie in:

1) Ensuring that safety standards and workplace regulation set in place by Alliance and Accord continue to be upheld strictly. This is essential to long-term national brading, value addition, as well as securing international support.

2) Pursuing bi-lateral Free Trade Agreements, Bangladesh can ensure better diplomatic relations as well as long-term preferential access to those markets. Preferential access may mean lower tariffs when exporting, similar to GSP that Bangladesh is currently enjoying. Bangladesh however has not established any FTAs to ensure such benefits when exporting to a specific country, despite being a member of regional agreements such as Bay of Bengal Initiative for Multi-Sectoral, Technical and Economic Cooperation (BIMSTEC) and South Asian Free Trade Area (SAFTA).

Negotiations continue in establishing FTAs with India, Sri-Lanka, and Turkey, while negotiations with China and Malaysia continue to remain uncertain.

Tackling Market and Product Diversification

An important problem to be addressed for the long term, is Bangladesh’s export earnings being concentrated to a small number of countries.

The key to long-term export sustainability lies in diversifying trade destinations so as to lower dependence on markets such as the U.S and the U.K who have moved towards near-shoring their products at competitive, if not lower prices owing to their adoption of automation and availing of economies of scale (See: SewBot Technology).[10] With the rise of fast-fashion and low global price of synthetic fibers, Bangladesh RMG faces rigorous competition.

The key to long-term export sustainability lies in diversifying trade destinations so as to lower dependence on markets such as the U.S and the U.K who have moved towards near-shoring their products at competitive, if not lower prices owing to their adoption of automation and availing of economies of scale (See: SewBot Technology).[10] With the rise of fast-fashion and low global price of synthetic fibers, Bangladesh RMG faces rigorous competition.

The upside to this tale is that the share of exports to non-traditional markets has grown significantly over the last few years and it is an encouraging sign for Bangladesh to continue market diversification.

This market diversification comes compounded with the need to expand the product range for RMG into higher-valued and/or diversified products.

BGMEA data showed that about 73 percent of the country’s total USD 34.13 billion RMG export earnings in the last fiscal year came from five items: T-shirts, Sweaters, Trousers, Jackets and Shirts. However, it has now identified 51 new products with high export potential which can be used to break further into non-traditional markets.[4] The focus for the next five years is currently on 31 of these products which have an estimated market size of USD 132 billion. Historically, these have generated USD 7.16 billion in export revenue in FY18-19.

Another prospect for moving up the global value chain of RMG-based products, is focus on Green RMG—which refers to the modification of the entire supply chain process for apparel products, starting from the Primary Textiles Sector, to ensure resource-efficient and sustainable practices.

Bangladesh currently leads the world in the number of LEED (Leadership in Energy and Environmental Design) certified green garment factories in Bangladesh, with 91 certified factories in 2019.[11] This may be lucrative in adding value to apparel through national branding. The opportunity is further apparent, given the growing market of ethically concerned consumers worldwide, and the high environmental cost of fast fashion.

The Future: Transforming the Supply Side

McKinsey states that among its surveyed respondents for a report, Bangladesh held the top spot as a source for affordable and high quality apparel products.[12] It is imperative that along with the attempts to diversify markets and the product range, there should also be focus given on the gradual adoption of automation and the upskilling of RMG middle-management and labor.

This will not only improve productivity and bring down costs, but will also improve compliance with the standards set by Alliance and Accord which are necessary for long-term sustainability and better international relations.

Sartaz Zahir, Trainee Consultant at LightCastle Partners, has prepared the write-up. For further clarifications, contact here: info@lightcastlebd.com.

References

- 1. Ongoing Upgradation in RMG Enterprises – Centre for Policy Dialogue (CPD)

- 2. EPB Export Data – EPB

- 3. RMG exports saw 8.76% growth last fiscal year – Dhaka Tribune

- 4. BGMEA Trade Information – BGMEA

- 5. CPD RMG Study – Stitching a better future for Bangladesh – RMG Study, Centre for Policy Dialogue (CPD)

- 6. Listed textile, RMG companies in a tight spot – The Daily Star

- 7. Ex ante assessment of the possible impacts of the graduation of Bangladesh from the category of Least Developed Countries (LDCs) – The United Nations Committee for Development Policy (CDP)

- 8. Trade Map for Cotton, ITC – ITC

- 9. LDC Graduation and its Repercussions for RMG – Centre for Policy Dialogue (CPD)

- 10. SewBots transforming the Textiles Industry – Robotics Tomorrow

- 11. Bangladesh leads world in green RMG production – The Daily Star

- 12. The apparel sourcing caravan’s next stop: Digitization – McKinsey

The post The Bangladesh RMG Sector: The Path to Revitalization by LightCastle Partners appeared first on LightCastle Partners.

Formalizing E-waste Disposal: As e-waste is different from general waste, a formal collection system should be modeled to handle e-waste separately from municipal solid waste. A supply chain channel creation is imperative to collect e-waste from the remotest part of the country and help in checking indiscriminate dumping.

Formalizing E-waste Disposal: As e-waste is different from general waste, a formal collection system should be modeled to handle e-waste separately from municipal solid waste. A supply chain channel creation is imperative to collect e-waste from the remotest part of the country and help in checking indiscriminate dumping.

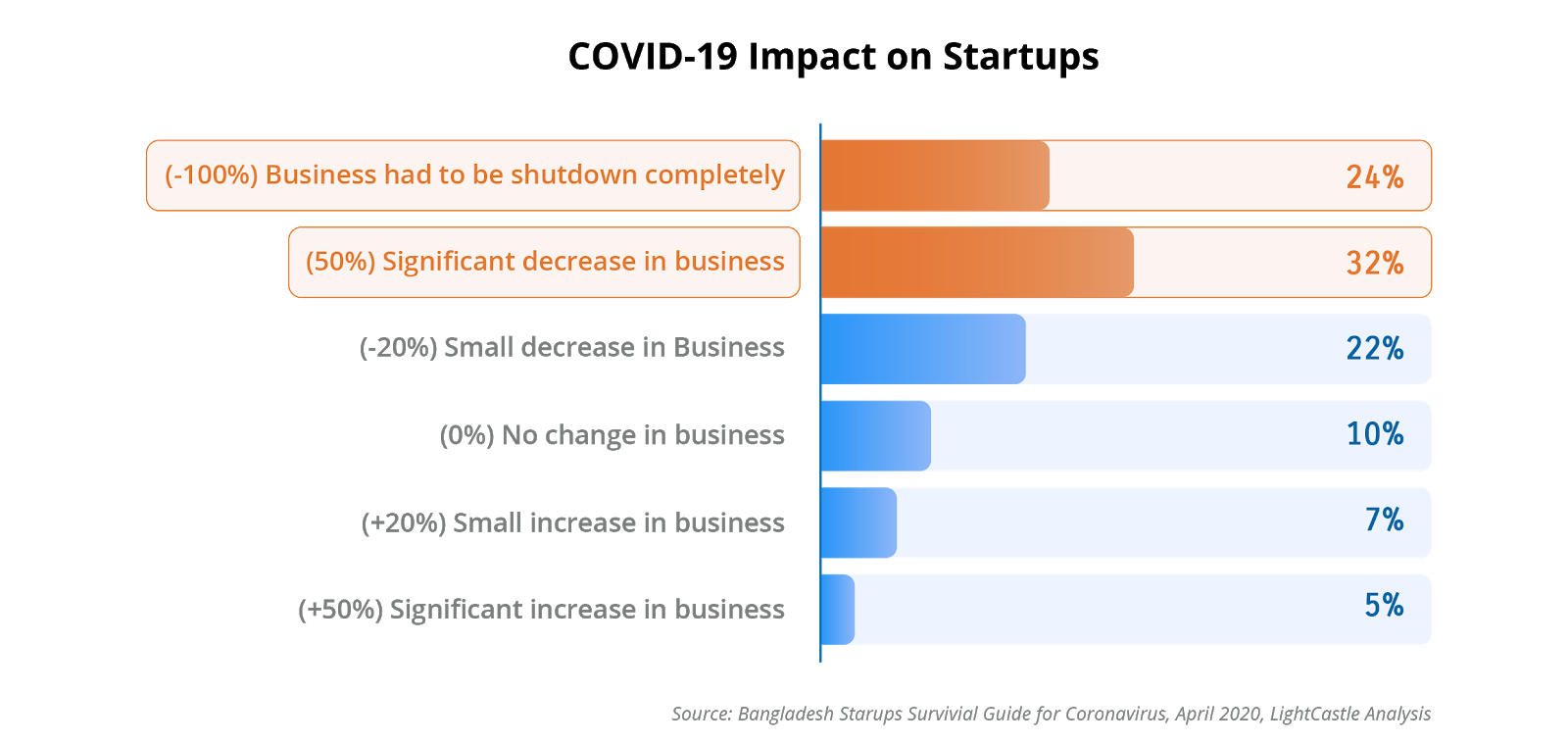

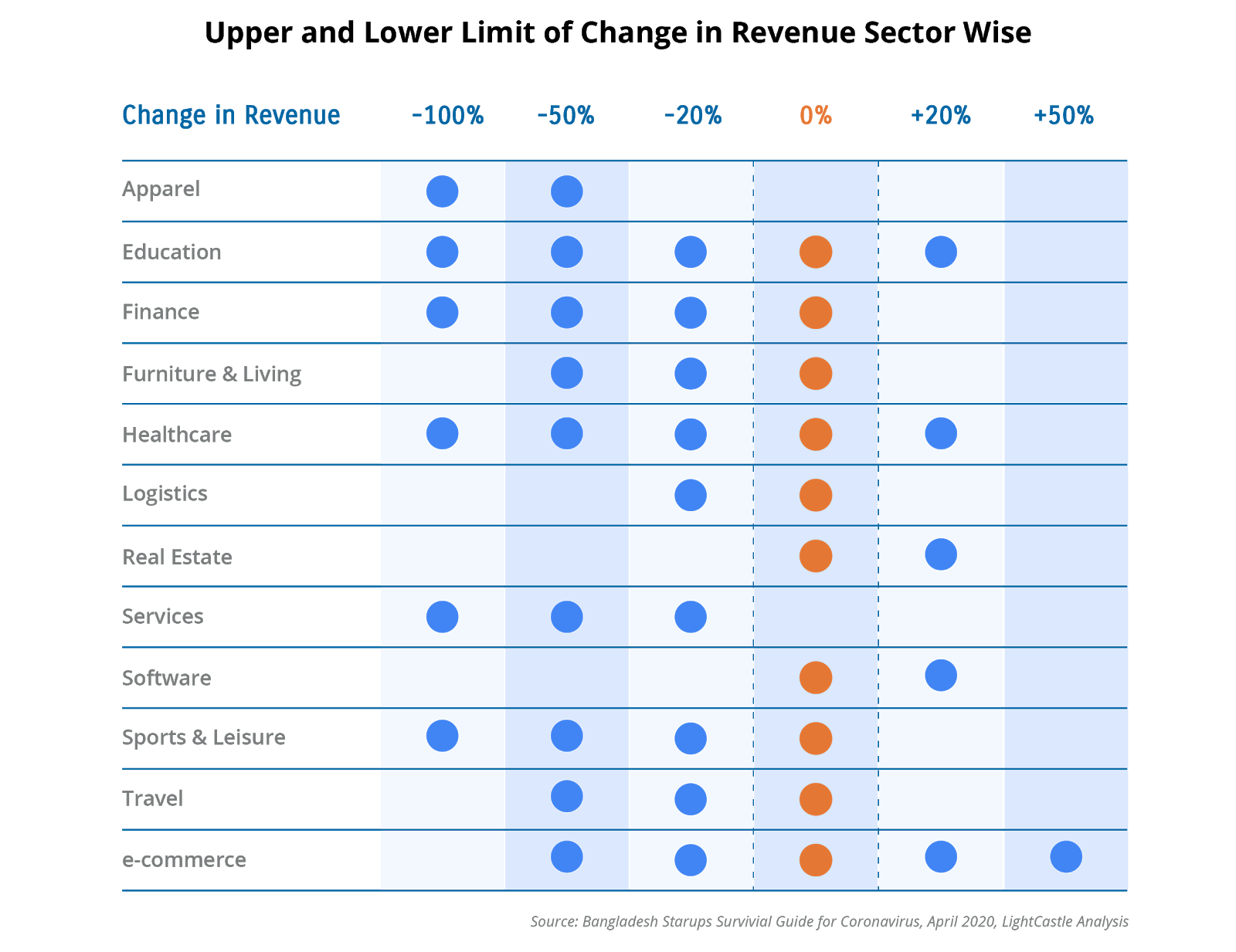

In Bangladesh, the coronavirus pandemic has hit sectors like Apparel, e-Services and Tourism the hardest. Education (including edutech), finance (including fintech), healthcare (including healthtech) sectors have faced an initial blow but might recover partially provided that consumers will need them more if the current situation persists. Although logistics sector players have reported a loss in revenue by 20%, the sector can bounce back if they improve their operational plan by partnering with e-commerce companies. With the onset of this lockdown, some of the e-commerce sector players have reported a 50% increase in business.

In Bangladesh, the coronavirus pandemic has hit sectors like Apparel, e-Services and Tourism the hardest. Education (including edutech), finance (including fintech), healthcare (including healthtech) sectors have faced an initial blow but might recover partially provided that consumers will need them more if the current situation persists. Although logistics sector players have reported a loss in revenue by 20%, the sector can bounce back if they improve their operational plan by partnering with e-commerce companies. With the onset of this lockdown, some of the e-commerce sector players have reported a 50% increase in business.

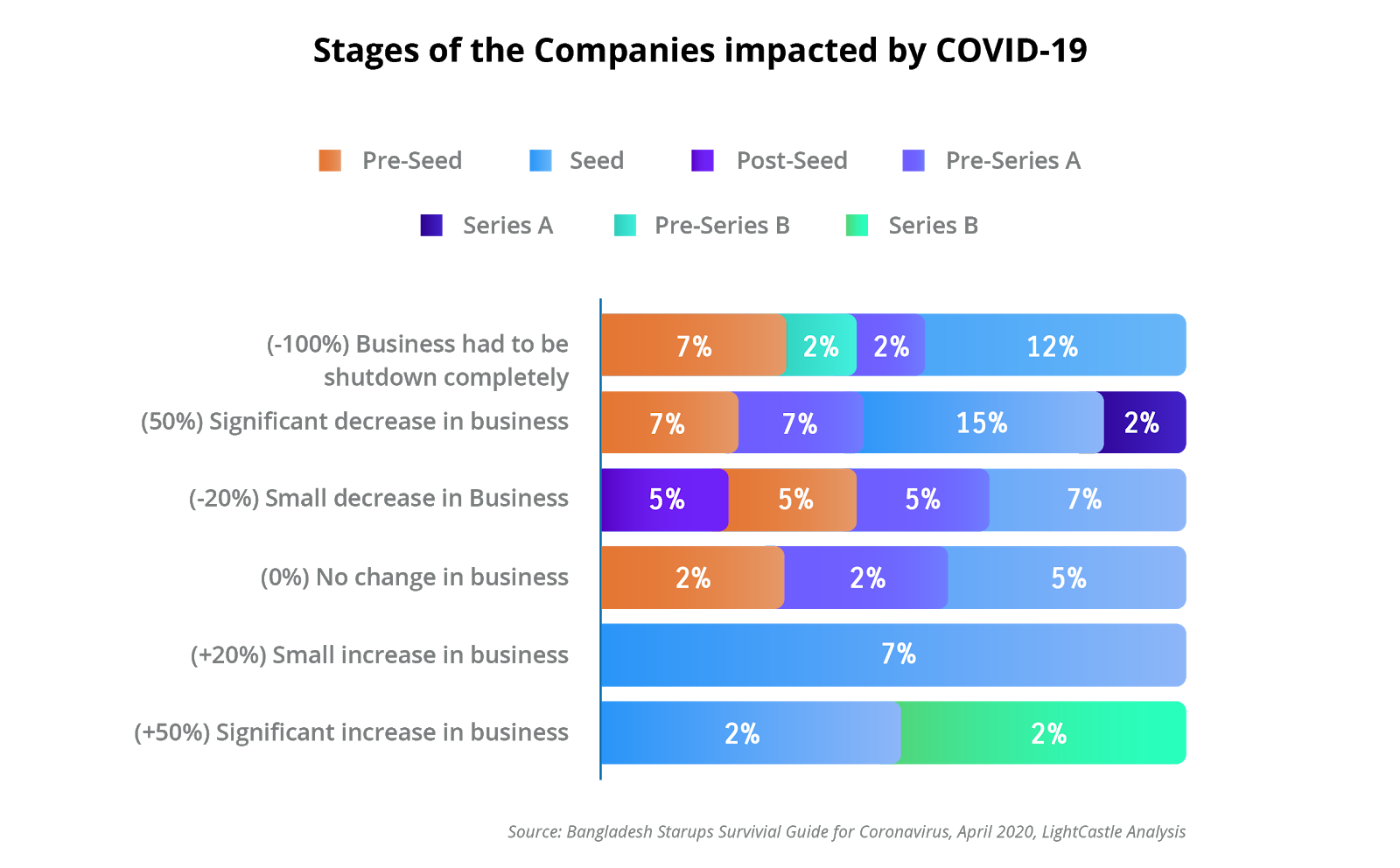

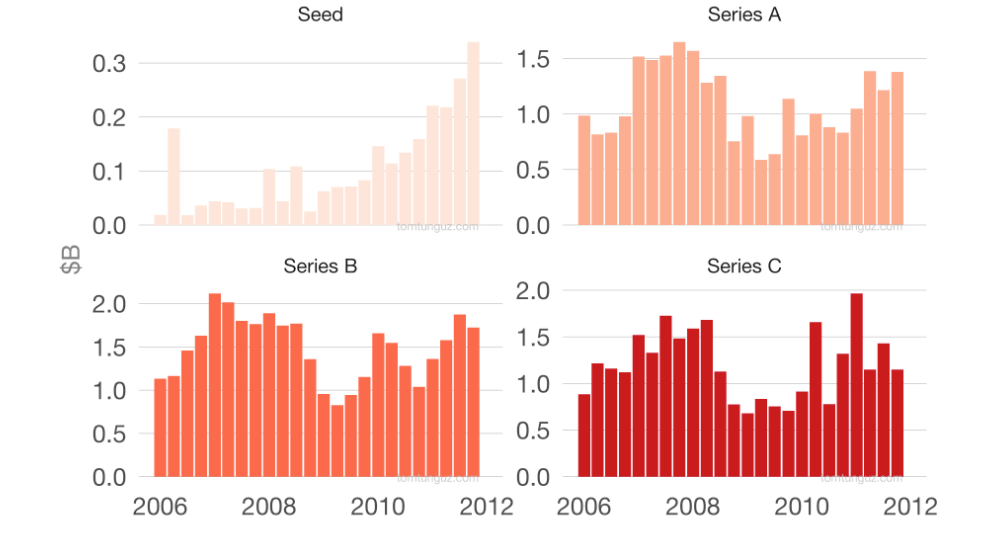

If we take a look at the 2008 financial crisis, we can observe the VC investment trend during a bear market. VCs invested around USD 3.5 Bn per quarter in seed, A, B and C rounds during 2006 which grew to USD 5 Bn per quarter in 2007 and early 2008. Then the investment velocity dropped by half to USD 2.9 Bn, USD 2.7 Bn and USD 2.3 Bn in the quarters following the crash. In the second quarter of 2010, the market finally bounced back. Seed was the fastest to recover while series C was the slowest. The long eight quarter rebound time might have worked in a recession-struck market but can take even longer in a post-pandemic world.

If we take a look at the 2008 financial crisis, we can observe the VC investment trend during a bear market. VCs invested around USD 3.5 Bn per quarter in seed, A, B and C rounds during 2006 which grew to USD 5 Bn per quarter in 2007 and early 2008. Then the investment velocity dropped by half to USD 2.9 Bn, USD 2.7 Bn and USD 2.3 Bn in the quarters following the crash. In the second quarter of 2010, the market finally bounced back. Seed was the fastest to recover while series C was the slowest. The long eight quarter rebound time might have worked in a recession-struck market but can take even longer in a post-pandemic world.

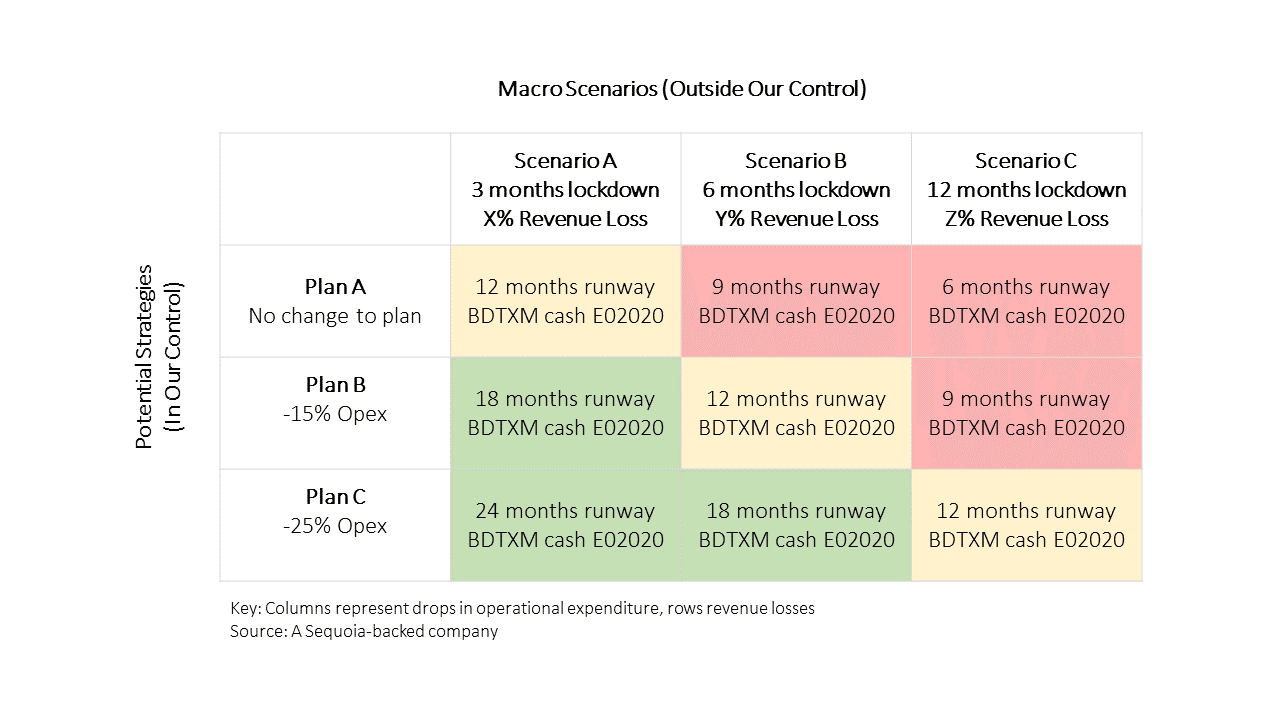

“Cash is King. The startups have to make sure that their cash goes the extra mile during this crisis.”

“Cash is King. The startups have to make sure that their cash goes the extra mile during this crisis.”

‘Given the current scenario, even if there is a reduction in valuation it is better to secure the investment sooner than later.’

‘Given the current scenario, even if there is a reduction in valuation it is better to secure the investment sooner than later.’